AMEX Membership Rewards (Canada)

Membership Rewards (MR) is the loyalty program offered by Amex Bank of Canada. You can earn points by using credit cards that are part of the MR program. These points can be used for various things like travel, paying for eligible purchases on your statement, getting merchandise, or purchasing gift cards.

-

Amex provides a variety of cards that offer MR points. It's important to note that these cards usually offer WB only once throughout your lifetime. Additionally, keep in mind that you can only have up to four (4) credit cards at a time. If you're interested in earning referral bonuses, you can refer to the Multiplayer Mode guide for more information.

Links for the cards are NOT affiliate links

-

Annual fee: $799

WB: 100,000*

MSR: $10,000

$200 annual travel credit (membership year)

$200 annual dining credit (calendar year, select restaurants)

$100 NEXUS statement credit every 4 years

2X points on dining & food delivery

2X points on travel

Complimentary HH Silver status

Complimentary MB Gold status

Complimentary Radisson Rewards Americas Gold status

Access to The American Express Global Lounge Collection

* to get the full bonus, you have to make a purchase from months 14-17, which means you have to pay the annual fee again

-

Annual fee: $250

WB: 60,000

MSR: $12,000

$100 annual travel credit (membership year)

$50 NEXUS statement credit every 4 years

2X points on travel

2X points on gas, grocery & drugstore

4 complimentary visits to Plaza Premium lounges across Canada (calendar year)

-

Annual fee: $155.88

WB:15 000

22,000 if you apply via referral

MSR: $9000

5X on Grocery and Dining (including Delivery)

3X on eligible streaming services

2X points on eligible gas, transit, travel*

* the cobalt card will no longer offer 2x on travel after October 8, 2024

-

No annual fee just earns 1x

-

Annual fee: $799

WB: 120,000*

MSR: $15,000

$200 in dell credits

$300 in indeed credits

1.25X points on everything

Access to The American Express Global Lounge Collection

* to get the full bonus, you have to make a purchase from months 14-17, which means you have to pay the annual fee again

-

Annual fee: $199

WB: 40,000

MSR: $5,000 USD

100 dollar in dell credits

10,000 points per quarter after spending $20,000 in first year

-

Annual fee: $99

WB: 65,000

MSR: $5,000

1,000 points per month after spending $3,000 in first year

10X points on office supplies & electronics, rides & gas, eats & drinks in your first 6 months up to 10,000 points

3X points on office supplies & electronics, rides &gas, eats & drinks

* charge cards

-

You are unable to transfer MR points between different users. However, you can link points from various cards to accumulate in the same MR account, making it easier for redemption purposes. This can be done through chat or phone. It's important to note that when linking MR accounts, the MSR counter will be reset.

-

You can use MR points to get discounts on your card purchases. Every 1,000 points can be redeemed for $10 towards eligible purchases. You can also use points for Amazon or PayPal purchases, with 1,000 points equal to $7.

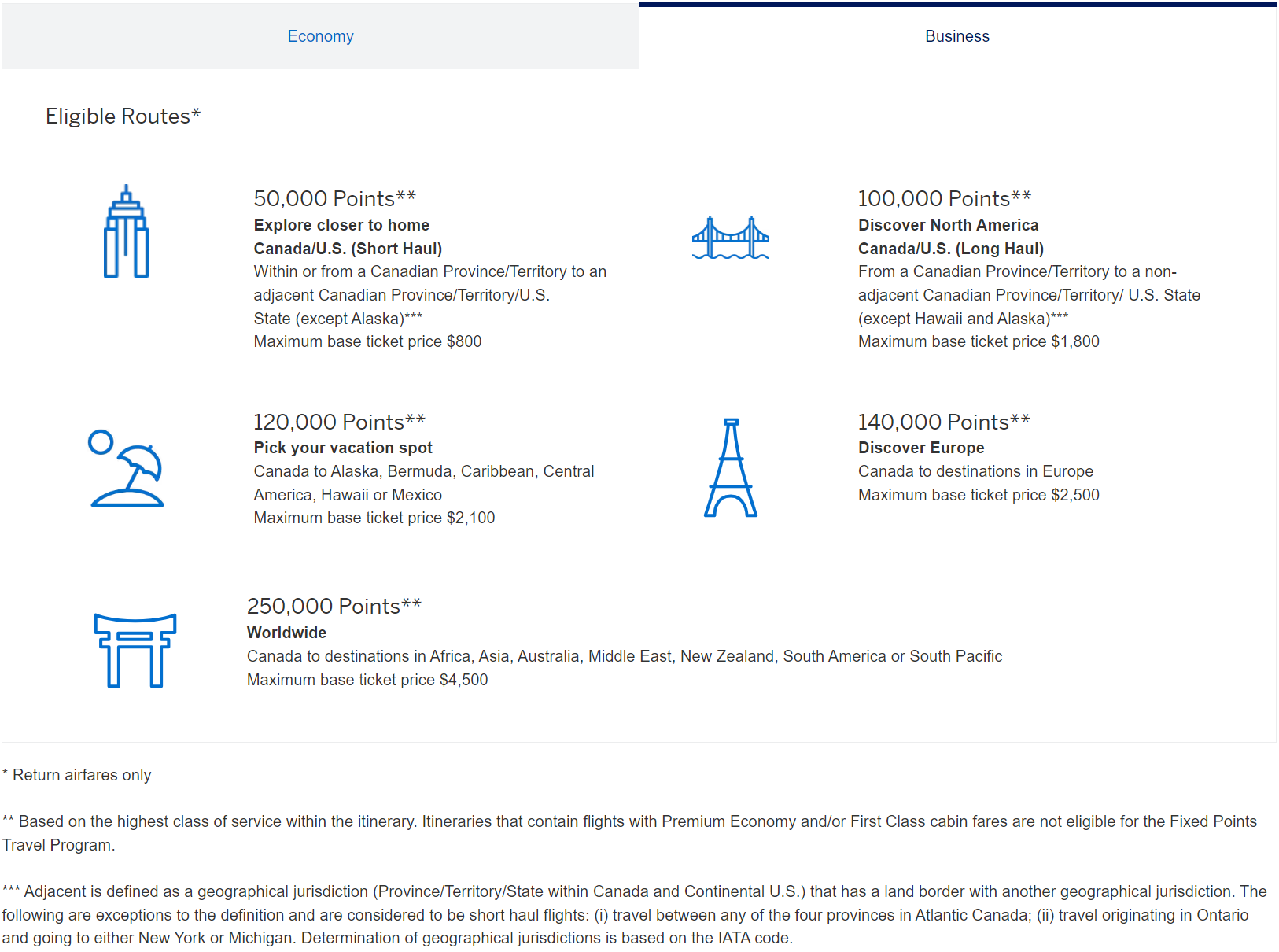

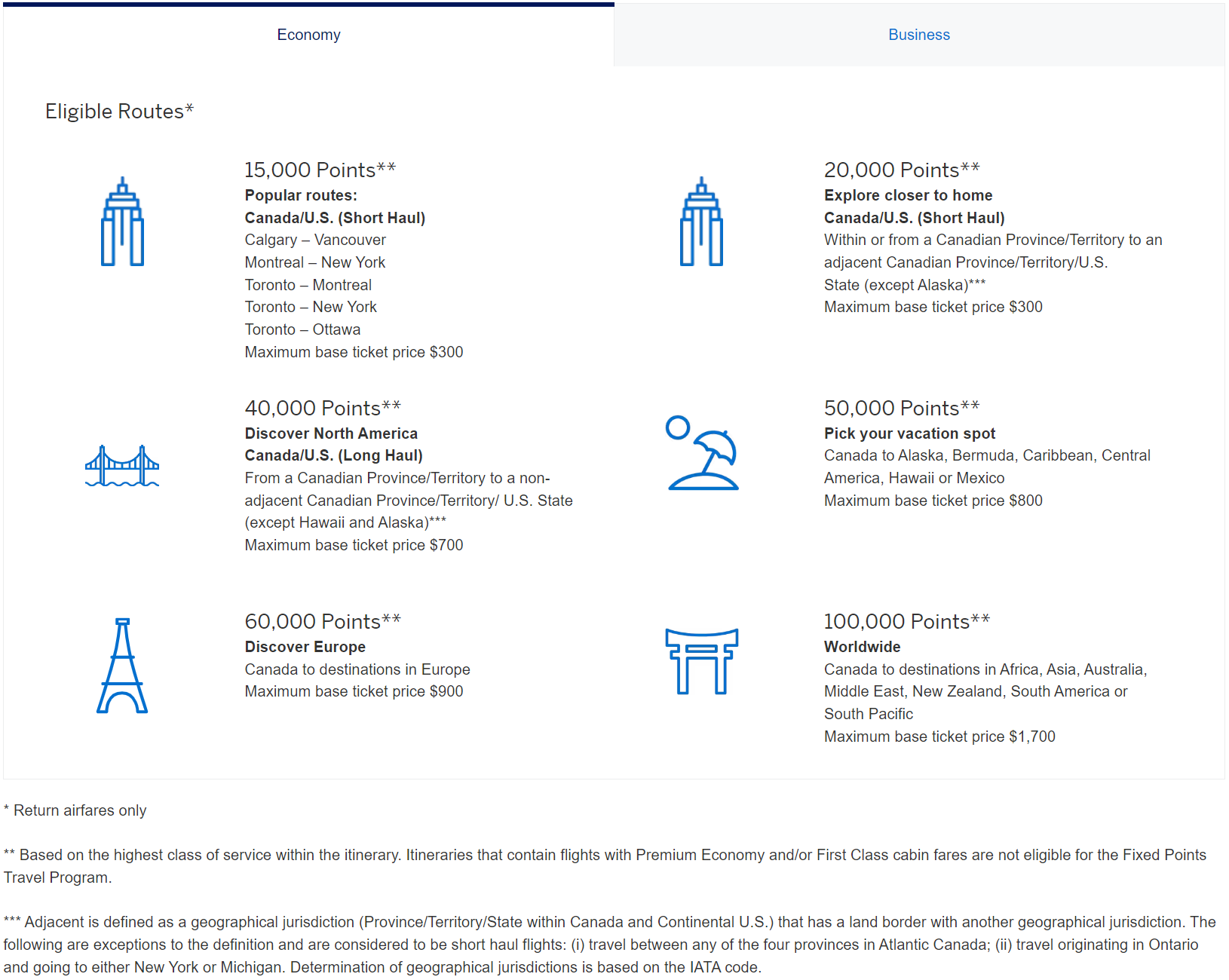

If you prefer to use your points for travel, Amex has the Fixed Points Travel Program. You can redeem points at a fixed rate based on your destination, up to a certain maximum price for the ticket.

For the Platinum and Gold cards, there's a trick called the refundable hotel trick to convert travel credits into cash. You can book a refundable travel reservation on the Amex Travel website and receive a credit on your account. Then, you can cancel the booking and get a statement credit instead.

-

You can convert your MR points into airline and hotel loyalty programs at specific ratios. Each conversion requires a minimum of 1,000 points. It's important to make sure that the account names in your MR account match with those in the airline or hotel loyalty account.

Airline partners

Air Canada Aeroplan 1:1

Air France-KLM Flying Blue 1:0.75

Cathay Pacific Asia Miles 1:0.75

British Airways Executive Club 1:1

Delta SkyMiles 1:0.75

Etihad Guest 1:0.75

Hotel partners

Hilton Honors 1:1

Marriott Bonvoy 5:6

International transfer

Furthermore, you have the option to transfer your MR points to another MR account in a different country. This can be helpful if you want to access different transfer partners. However, please note that there may be foreign exchange rates involved or a conversion ratio of 1:1, depending on which option is less favorable.

-

MR points will not expire if you have a card that earns MR points. However, if you close your account, your points will be automatically lost, unless you link them to another active card.

-

I have previously held X card, am I able to get the WB again?

Officially, Amex WB is usually offered only once in a lifetime. However, some reports suggest that the lifetime counter may reset after 7 years. There might also be a chance of getting the WB again before the 7-year mark. YMMV. There is no value in asking for DP.

I closed/received WB for X card Y years ago, how likely will I get the WB again?

It's not possible to predict with certainty. The closer you are to reaching 7 years since receiving the WB, the higher the chances of getting it again. However, the likelihood is not something that can be measured or quantified. YMMV. There is no value in asking for DP.

I am a supplemental user on my partner's X card, will I get the WB if I apply as the primary cardholder?

Being a supplemental user on someone else's card does not impact your eligibility for your own WB. It is assessed separately.

I previously held the Scotiabank Platinum/Gold American Express Card, am I eligible for the WB on the American Express Platinum/Gold Card?

The Scotiabank Amex cards are issued by Scotiabank and are not directly related to the Amex Bank-issued cards like the American Express Platinum/Gold Card. Although they both use the Amex payment network, they are separate entities and the previous card does not affect your eligibility for the WB on the Amex Bank-issued cards.

I currently hold the Scotiabank X Amex Card(s), does that affect my 4 credit card limit?

The restriction of holding only 4 credit cards at a time applies specifically to credit cards issued by Amex Bank and does not include all cards that use the Amex payment network. So, your Scotiabank Amex cards would not count towards the limit imposed by Amex Bank.

The above links point directly to the issuer of the card, Amex Bank of Canada, where you can confirm card details.

They are not affiliate or referral links. Prior to submitting your application, consider using a referral from r/churningcanada's monthly referral thread to help someone in the community.